Rising Global Public Debt: A Warning from the IMF And What It Means for the UK

20th October 2025

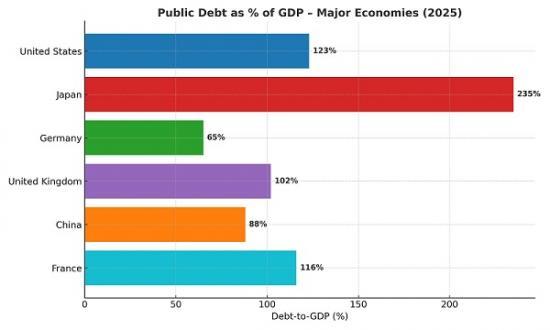

The IMF is issuing a clear, urgent alert: public debt worldwide has soared to levels not seen since the aftermath of World War II, and governments will need to act now if they want to preserve fiscal flexibility and economic resilience. For countries like the UK, the United States, France and Japan, where debt‐to‐GDP ratios already exceed or approach 100 %, the implications are especially acute.

The Global Debt Landscape: High, Rising and Risky

In its recent "Rising Debt Levels and Fiscal Adjustments" report, the IMF highlights several concerning global trends:

Global public (government) debt stands at around 92-93% of global GDP.

Total (public + private) debt is above 235% of global GDP.

Under current policies, public debt is projected to exceed 100% of global GDP by around 2029.

In a more adverse scenario, the IMF estimates public debt could reach about 123% of global GDP by 2029.

The drivers are familiar: large fiscal deficits, ageing populations, higher borrowing costs, investments for climate mitigation & infrastructure, and structural headwinds to growth.

The conclusion is stark: many countries cannot afford to defer fiscal adjustment, nor can they simply rely on growth alone to fix the problem. The choice is to prepare now or face more difficult decisions later.

Focus on Key Countries

Below are snapshots of five major economies — the UK, US, France, Japan and one additional for comparative context.

United Kingdom

The UK's debt burden is significant and on a worrying trajectory.

Data show the UK's general government gross debt around ~104% of GDP in 2023.

Projections indicate the UK's debt‐to‐GDP could rise to around 110.1% by 2029 (from ~104.3% in 2024).

Visual Capitalist

The IMF's analysis flags that the UK must address its "primary balance gap" (i.e., the gap between revenues and non‐interest spending) to stabilise debt. Delay will make adjustment steeper.

For the UK, the policy space is narrower than in some peers — borrowing has been high, growth remains modest and interest costs are rising.

United States

As the world's largest economy, the US has both strengths and vulnerabilities.

The US government's gross debt is about 123% of GDP in 2023.

Projections put the US debt‐to‐GDP at about 133.9% by 2029 according to one source.

Visual Capitalist

Although the US has deep capital markets, the size and speed of debt accumulation mean that servicing costs and market confidence are critical variables.

France

France is another advanced economy with a high debt load and fresh consolidation pressures.

Data show France's general government gross debt at around 110% of GDP in 2023.

One news source marks it at 114.1% of GDP in early 2025.

The IMF endorses the French government’s expressed commitment to reduce the budget deficit and monitor fiscal risks — but stresses that high debt ratios still limit flexibility.

Japan

Japan remains the most indebted major economy in debt‐to‐GDP terms.

Latest data put Japan’s general government debt at around ~255% of GDP in 2023.

Although much of the debt is domestically held and monetary policy has unique features (including negative interest rates for long periods), the sustainability question remains given demographic and growth constraints.

What the IMF Recommends — And What That Means for These Countries

Across the board, the IMF recommends several policy themes that apply especially to the countries above.

1. Credible Medium‐Term Fiscal Plans

The IMF emphasises that waiting to act increases the cost of adjustment. Countries should set out credible fiscal paths, combining revenue measures with spending discipline. For example, the UK should realistically project departmental budgets, investment needs and pension/health liabilities; the US should moderate deficit growth; France and Japan should reinforce structural reforms to support growth and limit debt accumulation.

2. Growth‐Friendly Investment

The key is not just reducing debt, but investing in productivity, education, infrastructure and climate transition. The IMF exhorts governments to focus on what they spend, not simply how much they spend. This is vital for all the five countries above — without growth, even steady borrowing becomes more burdensome.

3. Manage Debt Structure and Risks

The IMF points out that high debt is more manageable if:

the debt is denominated in domestic currency,

maturities are long,

refinancing risk is low,

borrowing costs remain under control.

In the UK, for example, most debt is in domestic currency, which is a plus — but rising global rates shift the challenge. In the US and Japan, complacency is dangerous given size and growth limitations.

4. Build Buffers & Fiscal Space

The IMF warns that without buffers, shocks (recessions, pandemics, trade wars, climate events) can force abrupt and painful adjustments. For the UK, US, France and Japan the message is: use good years to strengthen balance sheets. Don’t assume the next shock will be small.

The UK in Context

While the UK's debt position is serious, it is not the worst among advanced economies — Japan for example has debt more than double GDP. But the UK must understand this important nuance: having high debt but moderate risk is not the same as having high debt and high risk.

The UK needs to ensure that what follows next is a clear and credible plan — one that underscores transparency, realistic growth assumptions and structural reforms. Without that credibility, borrowing costs may creep up, policy flexibility may shrink and any future crisis will be harder to handle.

The IMF’s message is unequivocal: global public debt is high, rising and risky — and among major economies only some of the adjustment has been made. For the UK, the US, France and Japan, the challenge is substantial, but not insurmountable — if they act now with credible plans, smart investment and structural discipline.

For the UK, the time to act is now. Delay will only narrow options, increase cost and reduce resilience. The path may be politically difficult, but the cost of inaction could prove far greater.

For more details from the IMF go to

https://www.imf.org/en/Publications