Australia's rare-earth play - fast money and new plants

20th October 2025

Australia is rapidly shifting from raw-material supplier to strategic processor in the global race for rare-earth elements (REEs).

Fuelled by government finance, tax incentives and geopolitical demand for "trusted" supply chains, Canberra is backing a clutch of mines and downstream plants that, if successful, would loosen China's long-running grip on the sector.

Why Australia matters now

Rare earths (neodymium, praseodymium, dysprosium, terbium and others) are essential for electric-vehicle motors, wind-turbine magnets, defence systems and many advanced technologies. Australia has abundant resources; what it has lacked until very recently is large-scale domestic processing and refining capacity.

The federal government has moved fast to change that with big financing facilities, loan support for strategic plants, tax incentives for processing, and plans for a critical-minerals reserve — all intended to nurture domestic refining and create supply lines for allied countries. The policy push is both economic and geopolitical: diversify supply chains away from China and capture higher value-added activity onshore.

The current posture: money and projects

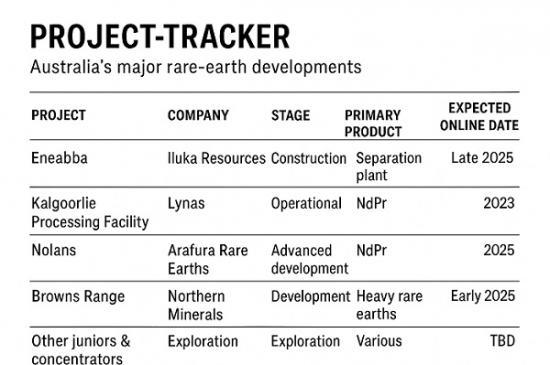

Several projects now dominate the landscape:

Iluka — Eneabba refinery (WA). Iluka has secured very large, government-backed financing to build an ore-to-oxide refinery at Eneabba. Company and government announcements show sizeable non-recourse loans and additional government grants/loans announced in late 2024. The project is among the sector's most advanced and has been accelerating construction activity.

Lynas — Kalgoorlie processing facility (WA) and Mt Weld expansion. Lynas is already the largest rare-earth producer outside China; it operates Mt Weld (ore) and has brought onshore processing capacity (Kalgoorlie) to add value. Lynas is pursuing expansions and global downstream projects simultaneously.

Arafura — Nolans project (NT). Arafura's Nolans is positioned as an ore-to-oxide operation aiming to supply separated rare-earth oxides. Company updates show Nolans progressing through project delivery stages and targeting export markets for NdPr oxides.

Northern Minerals — Browns Range (WA). Focused on heavy rare earths (dysprosium/terbium), Browns Range targets high-value HREs and is moving through development and permitting phases, with capital-raising and funding discussions ongoing.

Smaller and emerging projects. A range of juniors and mid-tier miners are advancing resources, pilot plants and concentrators that could feed larger processors in the coming years. (See tracker below.)

Taken together, these developments show Australia attempting to cover the full value chain — from mine to separated oxides and magnet-grade materials — rather than exporting raw cerium-rich ore alone.

Quick outlook and risks

The upside is clear: domestic processing captures more value and creates skilled jobs. Government loans and incentives lower project financing barriers and make downstream investment commercially viable.

The risks are technical, environmental and commercial: rare-earth separations are complex and produce problematic residues; projects still depend on steady ore supply and offtake contracts; and global price cycles and competition (especially from China) could pressure margins. Delivery risk remains material for every large-scale refinery.

Which projects are most advanced — a short verdict

Lynas (Kalgoorlie + Mt Weld) — the firm is the only large-scale producer with integrated operations and an existing onshore processing footprint; its facilities are operational and expanding.

Iluka (Eneabba) — backed by very large government support and now moving rapidly into construction; arguably the single biggest government-supported refinery build in Australia to date.

Arafura (Nolans) — close behind: a fully scoped ore-to-oxide project with commercial intent to supply.

Northern Minerals (Browns Range) — more niche (heavy rare earths) yet important; technically valuable but more exposed to funding/policy timing.