Cake versus Biscuit - A Fiscal Feast for the Sweet Toothed

20th October 2025

In the grand pantheon of British national debates—tea or coffee, football or rugby rain or more rain there lurks a lesser-known yet profoundly important question to cake or not to cake?. Not merely a philosophical inquiry, this is a matter of tax law, national pride, and digestive strategy.

At first glance, the choice seems trivial. Biscuits, with their crunchy precision and snap-worthy theatrics are a staple of tea-time rituals.

Cakes, on the other hand, offer spongy bliss and the occasional suspicious layer of jam. Yet hidden beneath these confectionery delights lies a question that could alter your wallet as dramatically as your waistline: which treat saves you money at the checkout?

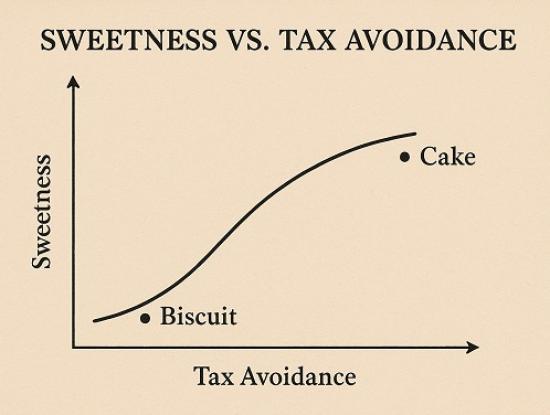

The UK government, in all its bureaucratic wisdom, has decreed that cakes are zero-rated for VAT, while biscuits are zero-rated only until they flirt with chocolate. At which point they are slapped with the full 20% tax. This decision, enforced with the stern rigor of an accountant wielding a teaspoon, has elevated cakes from mere desserts to fiscal superheroes. By contrast, chocolate-covered biscuits are the tax villains of the supermarket aisle, stealthily adding pennies to your purchase as they whisper, "Mwahaha... enjoy your overpriced snack."

History too favours the cake. The legendary Jaffa Cake trial of 1991 an epic courtroom battle where sponge met chocolate, and science met law—confirmed what many suspected: a Jaffa Cake is, in fact, a cake. The nation rejoiced. The accountants sighed. And chocolate-covered biscuits everywhere mourned their 20% burden.

From a practical standpoint, choosing cake over biscuits is not merely a moral victory it is a strategic economic manoeuver. A £1.00 chocolate digestive becomes £1.20 once the insidious VAT is added, while a cake of equal deliciousness glides past the till, smugly untaxed. One might even say that, in Britain, eating cake is both sweet and fiscally responsible, a rare combination in the otherwise cynical world of personal finance.

In conclusion, the choice is clear. When confronted with the eternal battle of biscuit versus cake, remember - one will crunch under your teeth, while the other protects your wallet. Choose wisely, eat heartily, and let the sweet tax law guide your way.

Your taste buds—and your accountant will thank you.

The Great VAT Bake-Off

In Westminster's hallowed fiscal halls,

Where logic trips and reason stalls,

A noble quest did once arise,

To tax the treats that tempt our thighs.

"Let’s charge them more!" the Treasury cried,

“For biscuits plain and cakes with pride!”

But lo! A storm began to brew

What counts as cake? What counts as chew?

A Jaffa Cake stood in the dock,

Its spongey soul a ticking clock,

“Is it a biscuit?” asked the Crown,

“Or cake that’s soft and slightly brown?”

The judge, with furrowed brow and spoon,

Declared his verdict late in June,

“It’s cake!” he said, “Though small and round

Its VAT-free rights are now profound.”

Yet Hobnobs, rich in oaty flair,

Were taxed like sin without a care,

Digestives, poor and chocolate-dipped,

Faced levies cruel and tightly gripped.

A Battenberg, with pink delight,

Escaped the taxman's hungry bite,

While bourbons, stoic, dark, and square,

Were burdened with fiscal despair.

So next you snack, dear citizen,

On custard creams or cake with gin,

Remember this absurd divide,

Where sponge is safe, but crunch is tried.