Economic update - Low growth leaves Chancellor with decisions to make

1st November 2025

The House of Commons Library published on 27 October 2025 some interesting thoughts on the upcoming budget.

Economic growth remains slow, productivity forecasts are likely to be downgraded and government borrowing is at almost the highest on record.

On 26 November 2025, the Chancellor will deliver her second Budget to Parliament. Although we won't know for sure what it contains until the Chancellor makes her speech, this month's economic news gives us some clues about what might be weighing on her mind.

This Insight looks at recent figures on growth, public spending and productivity, and considers what this might mean for next month's Budget.

Productivity forecasts are likely to be downgraded

The UK's economy continued its trend of relatively slow growth in October 2025, with the latest figures suggesting that GDP grew by 0.3% in June to August 2025 compared with the previous three months. This was the result of modest growth in the services and construction industries, offset by a decrease in activity in the production industries.

Economic growth is related to productivity, and according to the Office for National Statistics (ONS), productivity has had stubbornly low growth since 2009. Output per hour worked was slightly lower in April to June 2025 than it had been the previous year (down by 0.8%). However, recent estimates from the Resolution Foundation, a living standards think tank, indicate that because of problems with labour force data, recent productivity growth could actually be somewhat higher than official figures suggest.

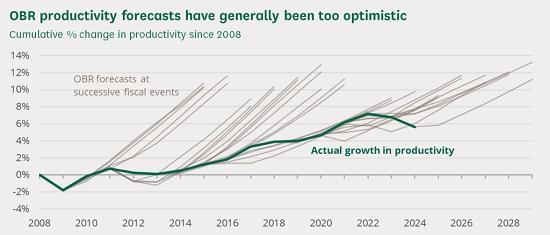

Media reports suggest that the Office for Budget Responsibility (OBR) will downgrade its earlier productivity forecasts in its report to be published alongside the upcoming Budget. This comes as no surprise to many commentators (or to the OBR itself), who have noted that the OBR has often been somewhat over-optimistic with these forecasts (as the grey lines in the chart below show).

Retail sales remain static as households save more

According to analysis published in the Financial Times on 11 October 2025, the UK's lacklustre economic growth since the covid-19 pandemic may also be partly caused by consumer behaviour. As the chart on the left below shows, retail sales volumes have been largely static since the pandemic, in sharp contrast to their steady growth between 2013 and 2019. At the same time, household savings ratios have increased. Households were holding on to about 4% of their available resources in the middle of 2022, but this rose to about 11% by the middle of 2025.

This caution over consumption may be linked with the effects of inflation. The Consumer Prices Index (CPI) in September 2025 was 3.8% higher than it had been a year before. Not only is this higher than the Bank of England's target of 2%, but it also contributes to the longer-term increase in prices. As the chart on the right above shows, consumer prices (as measured using the CPI) have risen by 29% since January 2020.

Government borrowing is higher than forecast

There was both good and bad news for the Chancellor on the public finances this month. The International Monetary Fund's latest Fiscal Monitor, published on 15 October, forecasts that the UK's net borrowing will reach 2.2% of GDP by 2030, lower than almost all other G7 countries. Only Canada is forecast to have lower borrowing at 1.5% of GDP.

On 8 October 2025, HMRC announced that it had found an error in its figures for the amount of VAT raised. This was more good news, as it meant that the government had collected more tax revenue than it had previously thought, and as a result, total government borrowing between April and August 2025 was reduced by £2.0 billion.

However, even with this extra money, borrowing between April and September 2025 was almost the highest on record at £99.8 billion, only surpassed by borrowing during the covid-19 pandemic in 2020. This borrowing figure is £7.2 billion higher than the OBR had forecast in March 2025.

Higher borrowing, particularly if it continues into later years, will make it harder for the Chancellor to meet her fiscal targets at next month's Budget. This is because the targets are based on levels of borrowing and debt. However, if the OBR downgrades its productivity forecast as expected, this will likely have more of an effect on whether the fiscal targets are met. Accounting for a productivity downgrade and other factors, the Institute for Fiscal Studies has estimated that the Chancellor may need to raise tax revenue or cut spending by a total of £12 billion to meet her fiscal targets at all. This amount rises to £22 billion if she wants to restore the (relatively tight) margin that she gave herself at the 2025 Spring Statement.

Read the article with links to more information HERE