Oh No Another Steath Tax On High-street Businesses

29th November 2025

The term "stealth tax" refers to tax increases or charges that aren't obvious as they don't come from raising headline rates, but from policy changes, threshold freezes, revaluations or structural tweaks that quietly push up what people/businesses pay.

Essentially, the government doesn't announce a big "tax rise" instead, costs rise because valuations, thresholds or reliefs shift, so people/businesses feel the pain even if the "official tax rate" stays the same.

We start with England and Scotland lower down this page.

Why business rates are now being called a stealth tax on high-street businesses

Recent changes to business rates in the UK have triggered strong criticism from retailers, pubs, hospitality and leisure businesses — many calling the result a stealth tax. Here's how that works:

The government has publicly pledged to "reform" business rates and to introduce "permanently lower tax rates" for many retail, hospitality and leisure (RHL) properties from 2026.

However at the same time the assessed "rateable values" of many high-street properties have recently been re-valued much higher. That means, even if the rate multiplier (the "tax rate" on that value) is slightly reduced or only modestly changed, the overall bill skyrockets because it's being applied to a much larger value.

For many pubs, shops and small venues, this results in huge increases in business rates bills — sometimes hundreds of percent over a few years.

At the same time, any reliefs or discounts (e.g., pandemic-era rate reliefs, small-business discounts, temporary multipliers) are being reduced or phased out — effectively removing earlier support.

The effect: high-street businesses end up paying more, often with little advance warning or explicit tax-rise announcement — hence, many call it a "stealth tax."

What this means in practice for shops, pubs, high-street businesses

Sharp increases in overheads: Some pubs or small retailers report business-rates bills rising from a few thousand to tens of thousands — significantly affecting profitability.

Risk to viability as Many small businesses operate on thin margins. If business-rates costs surge suddenly, it can force them to raise prices, cut staff, or worst case close altogether.

Uncertainty for future investment: When valuations, reliefs or multipliers shift unpredictably, businesses find it hard to plan — expansion, hiring, refurbishment become risky.

Perceived unfairness: Many feel the burden is shifting onto high-street and small businesses while large warehouses, online fulfilment centres or big property holders avoid proportionate increases — or benefit more from relief schemes.

Why many call this more harmful than a straightforward tax rise

Because business-rate bills rise via revaluations, relief removals or multiplier changes — rather than via a clear “rate hike” — it's harder for businesses and the public to anticipate or lobby against. The changes often feel sudden, and the justification tends to be opaque. That's the essence of a stealth tax: the tax burden rises, but not “officially.”

Moreover, when combined with wider cost pressures — inflation, energy, wage rises, supply-chain costs — the sharp hidden increase in business rates can feel like a heavy blow precisely when businesses are already vulnerable.

The big picture: Shifting the burden — and the risk — onto high-street businesses

The argument from critics is that the new business-rates regime amounts to intentional policy design: property valuations are updated, reliefs are cut, multipliers tweaked — the government claims support for high streets, but the hidden math pushes the burden back onto them. In effect, high-street shops, pubs, small retailers and hospitality venues are being used to plug public-finance gaps. That's why many in the sector describe the measures as “stealth taxes.”

Whether this approach is sustainable or fair remains contentious. Many warn it could accelerate closures on high streets, hollow out town centres, and undermine the very businesses the government claims to support.

Related recent coverage on this issue

ft.com

Changes to business rates lead to accusations of a new stealth tax

Yesterday

thetimes.com

Rachel Reeves buried tax rises in 'smoke and mirrors budget'

Today

theguardian.com

Business rates rise would put hundreds of big shops at risk, say UK retailers

Does this also apply in Scotland?

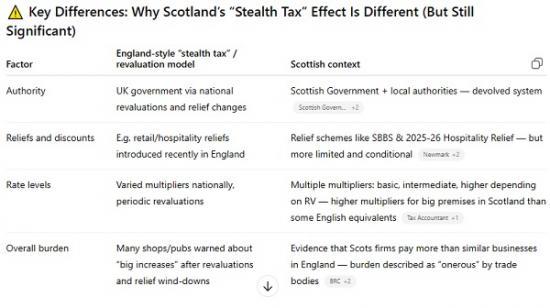

Yes the “stealth tax” / business-rates pressure for high-street businesses can apply in Scotland — but only partly, and in different ways than in England. The overall principle of business/property-tax burden remains, but the system is devolved — so the details, reliefs and rules differ.

Here’s how it works (and how it’s different) in Scotland

🇬🇧 Business rates in Scotland are devolved & follow a different system than England

In Scotland, non-domestic (business) rates — often called “NDR” — are controlled by the Scottish Government rather than the UK government. The Scottish Government sets the “poundage” (the rate per £ of rateable value) and local councils handle billing.

That means reforms in England (e.g. revaluations or relief changes) do not automatically apply in Scotland.

What remains similar — high street businesses in Scotland still face business-rate pressure

Scottish businesses are still liable to business rates based on the rateable value (RV) of their premises. Higher-value commercial premises pay more under “intermediate” or “higher” property-rate multipliers.

Recent data shows that many Scottish firms will pay more in rates than equivalent firms in England. For 2025-26, it’s estimated Scottish businesses will pay ~£55 million more than their English counterparts — partly due to a higher “higher property rate” on large premises.

For mid-sized and larger properties (e.g. shops, pubs, hospitality, retail) the burden remains “onerous” — and many businesses survey this as a tax-like burden that squeezes margins, reduces investment, or threatens viability.

This means the idea of a “stealth tax” — i.e. hidden or incremental increases in tax burden via revaluations, higher multipliers, reduced reliefs — does apply in broad terms to Scotland.

But Scotland offers different reliefs — so outcomes vary

Because Scotland runs its own system, there are some relief measures not seen (or not as generous) in England — but also some gaps. For 2025/26:

There is a 40% “Hospitality Relief” available for eligible hospitality-type premises (e.g. pubs, hotels, small venues) with a rateable value up to £51,000. That offers some discount for smaller hospitality businesses.

A long-standing scheme, the Small Business Bonus Scheme (SBBS), continues to cover many small businesses — in some cases leading to partial or full exemption of business rates, depending on the size/value of the premises.

However, some Scottish high-street businesses say they’re missing out on reliefs that are being applied in England or Wales — making the burden comparatively heavier.

So reliefs are there — but they are conditional, limited in value or size, and do not always offset the pressure from higher rates on larger or mid-size premises.

business-rate burden and the risk of “hidden tax hikes” exist in Scotland too. But because Scotland’s system is different and has its own mixture of multipliers and reliefs, the effects vary: for some smaller businesses, reliefs may mitigate the worst; for others (especially mid-size / high-value premises), the pressure can be severe — sometimes worse than in England.

The “Stealth Tax” Problem Does Apply in Scotland But in a Distinct Way

The structural possibility for a “stealth tax” via business rates is definitely present in Scotland.

High-street shops, pubs, retailers and hospitality businesses — especially midsize or larger ones — remain vulnerable to rising business rates, rate increases, or reduced reliefs.

Reliefs like the SBBS or targeted hospitality relief help cushion the blow for some smaller businesses — but they do not cover all premises, and many still face large increases.

Compared to England, the burden on some Scottish businesses appears heavier, especially for larger or higher-value properties.

Small independent shops/pubs have a real chance under Scottish relief schemes (SBBS + hospitality relief) to pay much less than base rates — sometimes nothing.

Mid-size businesses may get some relief — but if their premises’ RV is near or above the relief thresholds, they risk paying similar bills to English equivalents, or slightly less/more depending on RV and multiplier.

Larger shops or chains — especially those occupying large/high-value properties are likely to pay more in Scotland than equivalent sized properties in England, especially since higher-rate multipliers are higher.

Because of relief thresholds and caps, there is a “cliff-edge effect” crossing certain RV bands can sharply increase bills (or remove relief), making expansion risky for small/medium businesses.

Scotland offers strong relief support to small and small-to-medium high-street businesses; this can substantially lower business-rates bills, making it cheaper than equivalent properties in England — but only if the business’s rateable value and structure meet strict eligibility rules.

For larger businesses or shops with high RV, bills in Scotland tend to be slightly higher than in England, placing a heavier burden on bigger high-street premises north of the border.

The system’s complexity (RV bands, relief thresholds, varying multipliers, periodic RV revaluations) contributes to what many describe as a “hidden” or stealth tax burden, especially risky for businesses that expand.

For businesses that have been hit with higher national insurance contributions, increased minimum wage rates and higher energy costs the new business rates may be an ominous start to the next financial year