The £20,000 Stealth Tax: - How Frozen Allowances Drain Family Finances

30th November 2025

Budgets are often sold as moments of fairness. Ministers insist that everyone must contribute, that the burden is shared.

Yet the Chancellor's decision to freeze personal tax allowances until 2031 is a classic stealth tax — invisible in headline rates, but painfully obvious in pay packets.

For ordinary households, the cost is staggering.

What's Been Frozen

Personal allowance: Stuck at £12,570 since April 2021.

Higher‑rate threshold: Stuck at £50,270.

Extension: Both frozen until April 2031.

Normally, these thresholds rise each year with inflation. By 2031, the personal allowance would have been around £19,500 if uprated. Instead, it stays at £12,570.

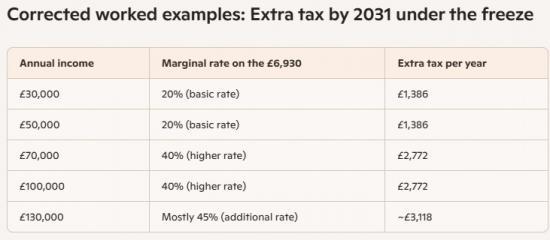

The Extra Tax Bite

Difference per person: ~£6,930 of extra taxable income each year.

Basic rate (20%): That's £1,386 extra tax per person per year.

Couple: Nearly £2,800 extra tax per year.

Over the freeze (2021-2031): A typical household could pay £20,000+ more tax than if allowances had risen normally.

This is fiscal drag in action whee wages rise, thresholds don't, and the Treasury quietly collects billions without changing headline rates.

Why It Matters

Invisible rise: No one's tax rate has gone up, but more of your income is taxed.

Families squeezed: Pay packets feel lighter even as wages rise.

Treasury windfall: Billions raised by stealth, sold as "shared sacrifice."

The freeze is not a technicality. It's a deliberate policy that shifts the burden onto households without the political risk of announcing a tax hike.

By 2031, families will be paying tax on nearly £7,000 more income per person than they would have under normal uprating. That's a hidden burden of £20,000+ per household over the decade. The Chancellor may claim fairness, but the freeze is a stealth tax that drains family finances while leaving headline rates untouched.

In the politics of pain, this is the quietest tax rise of all — invisible in speeches, but relentless in pay packets.

Note

The examples are based on estimates so thing could be slightly better or worse depending on inflation and other government decisions.