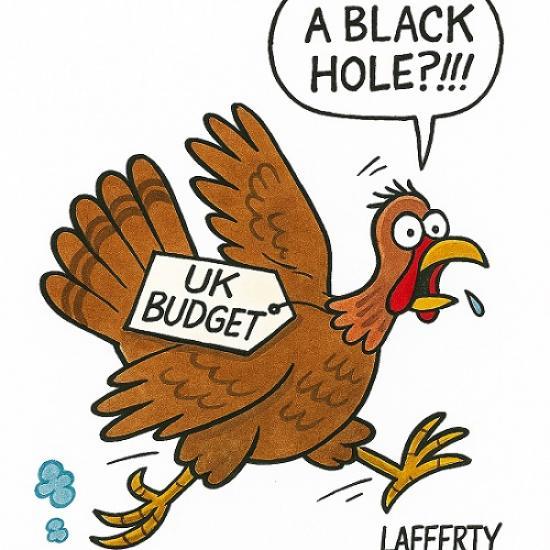

Turkey Before Christmas? The Budget That Gobbled Up Trust

1st December 2025

When Chancellor Rachel Reeves unveiled her Autumn Budget on 26 November, she framed it as a response to a looming fiscal crisis — a £30 billion "black hole" in the public finances.

This narrative justified £26 billion in tax rises, including freezes on thresholds, changes to pension salary sacrifice, and new property levies.

But within days, the Office for Budget Responsibility (OBR) revealed that the actual shortfall was closer to £4.2 billion, and in some forecasts, even a surplus.

This revelation triggered a political firestorm. Critics accused Reeves of overstating the deficit to justify unpopular tax hikes.

The Prime Minister was forced to defend the Chancellor amid calls for her resignation. The budget, once billed as a responsible reset, began to look like a strategic overreach — or worse, a fiscal fiction.

What Was in the Budget?

£26bn in tax rises: Including dividend tax hikes, pension contribution caps, and property levies.

Threshold freezes extended to 2031

A stealth tax that drags more earners into higher bands.

Spending increases

Welfare spending rose by £16bn, including boosts to Universal Credit and pensions.

Growth concerns

Analysts warned the budget could stagnate GDP and deepen future fiscal gaps.

Was the Black Hole Real?

OBR figures contradicted the claim: The watchdog said the Treasury had been informed weeks earlier that the fiscal gap was far smaller.

Political fallout

Reeves was accused of misleading the public, and the opposition demanded an investigation.

Economic impact

The Growth Commission warned the budget could hit growth by 2% by 2030, undermining its own revenue projections.

This budget may have been well-intentioned, but its credibility was undermined by shaky foundations.

The "black hole" narrative used to justify sweeping tax hikes now looks more like a rhetorical device than a fiscal necessity.

For many voters, it felt like a Turkey before Christmas: overstuffed with tax rises, undercooked on growth, and served with a side of political drama.