Modest house price growth may offset easing mortgage costs for home buyers this year

7th January 2026

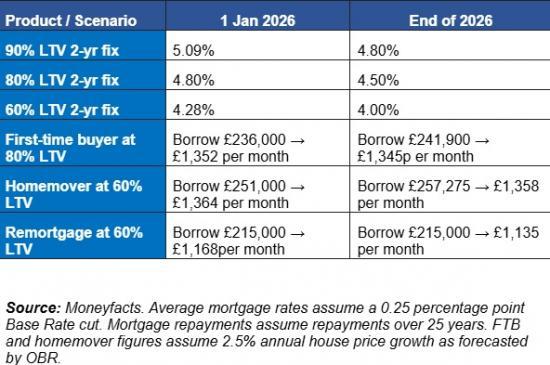

Analysis of new data* from Moneyfactscompare.co.uk illustrates how easing mortgage rates may allow for a modest growth in house prices in 2026 without improving or worsening current affordability pressures on first-time buyers and homemovers.

*Consumers comparing mortgage deals on moneyfactscompare.co.uk in 2025 and Moneyfacts Average Mortgage Rates.

First-time buyers

Typical first-time buyers borrowed around £236,000 in 2025

Average property value of around £310,000

Average loan-to-value (LTV) of 78% // Avg deposit of 22%

Homemovers

Typical homemover borrowed around £251,000 in 2025

Average property value of around £466,000

Average LTV of 58% // 42% equity

Remortgage borrowers

Typical remortgage customer borrowed around £215,000

Typical property value of around £460,000

Average LTV of 50% // 50% equity

Average mortgage rates

Markets currently predict the Bank of England will lower the Base Rate from 3.75% to 3.25%-3.5% this year.

Adam French, Head of News at Moneyfactscompare.co.uk

Moneyfactscompare.co.uk, said, "After more than three years of higher borrowing costs, even small cuts in mortgage rates can have a meaningful effect on buyer behaviour. With markets expecting at least one further 0.25 percentage point cut to the Base Rate, the mortgage landscape in 2026 may be more forgiving than at any point since 2021.

"Our modelling suggests that easing rates may make modest house price growth possible without stretching affordability further, an important shift after the intense affordability squeeze of 2022-2025.

"First-time buyers still face the steepest challenges, with many stretching to higher LTV deals given the need to save a considerable deposit. In contrast remortgage borrowers - who typically hold far more equity and are unlikely to need to borrow more - stand to benefit most from easing rates.

"Any expectation of more substantial growth should be tempered by the fact that borrowing costs remain well above the ultra-low levels of the 2010s. Even with rate cuts, affordability remains tight.

“Lower rates remove a headwind rather than create a tailwind, making modest house price growth possible, but not guaranteeing it. Unless rates fall further or incomes rise faster than expected the headroom for growth is likely to remain tight."