Business Rates Backlash - Why England and Scotland Firms Are Feeling the Pinch

8th January 2026

Business rates are a tax on most commercial properties, including shops, pubs, restaurants, hotels, offices, warehouses and factories. They are the main property tax that businesses pay to local authorities each year and are calculated based on:

a property's rateable value (an estimate of its annual rental value).

multiplied by a multiplier (poundage) set by the government

The result is the annual bill a business must pay to the council. Both England and Scotland revalue properties every few years to update rateable values to current market conditions. The next revaluations in both countries take effect from 1 April 2026, based on values around 2024. This means many rateable values will change — often upwards — for the first time since the last revaluation before the pandemic.

Key difference: Business rates policy is devolved. Scotland, England, Wales and Northern Ireland each set their own multipliers, relief schemes, and support measures.

How Business Rates Work in England

In England, business rates bills are calculated by applying a multiplier (set by national government) to the property's rateable value. There are relief schemes intended to reduce bills for smaller businesses or particular sectors:

Small Business Rates Relief offers discounts for very small firms

Retail, Hospitality and Leisure (RHL) relief was introduced during the pandemic and extended, offering a discount on bills

From April 2026, the multiplier system is changing — with two lower multipliers for retail, hospitality and leisure properties under a certain value, and a higher multiplier for larger properties — intended to rebalance the system for high street businesses. Transitional relief will help soften impacts for some ratepayers, but bills will still rise for many as rateable values climb after revaluation.

How Business Rates Work in Scotland

In Scotland, the system is broadly similar — rateable values multiplied by a poundage to determine bills — but with different relief schemes and policy choices:

Small Business Bonus Scheme (SBBS) lets genuinely small firms pay reduced or no rates up to certain thresholds

Other reliefs (e.g., for islands, charities) vary by local scheme.

Unlike in England, there is no permanent Retail, Hospitality, Leisure discount at the same level

Rateable values drafted for the 2026 revaluation are rising sharply in many sectors, especially hospitality and accommodation, leading to much larger future bills for some businesses

Scottish rate multipliers are sometimes higher than England's, meaning the same property can attract higher rates north of the border.

Scottish councils also have devolved powers over empty property relief and local relief schemes, and recent legislation had to be corrected after a drafting error affecting vacant property charges — an issue the Scottish Parliament has addressed with emergency legislation.

Why Businesses Are Protesting Now

Businesses — especially pubs, restaurants, shops, hotels and small firms — have been vocal about business rate changes and bills rising. The protests are not just about the end of COVID relief; it's a combination of several factors:

1. End of Pandemic‑Era Relief

During the COVID pandemic, governments introduced generous business rate relief (often 75% or more off bills) for retail, hospitality and leisure businesses to keep them afloat during lockdowns. In England, this relief is being phased out or replaced with lower permanent discounts from April 2026. Until now, temporary reductions shielded many businesses from higher bills.

Now those COVID‑linked reliefs are ending, bills that had been suppressed are rising — and businesses are seeing historically large increases.

2. Sharp Revaluation Increases

The 2026 revaluation updates rateable values to current market levels. In many areas — especially city centres and hospitality assets — draft valuations have risen steeply, sometimes over 20% on average and much more for some individual properties. These valuation increases directly translate into larger bills, even if the rates system hasn't changed.

3. New Multiplier Structure & Higher Charges for Some

In England, the government's new system uses lower multipliers for smaller RHL properties but introduces a higher multiplier for properties with rateable values above £500,000. Businesses occupying larger premises — including sizeable pubs, warehouses and big high street outlets — are concerned this will sharply raise their bills.

In Scotland, the lack of equivalent permanent RHL relief and rising rateable values means many smaller hospitality businesses will not benefit from the same discounts available in England, and in many cases will pay more relative to their English counterparts.

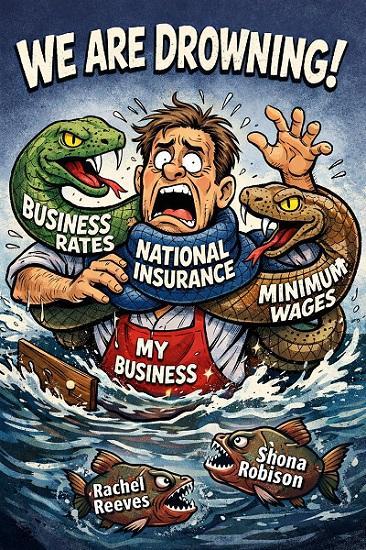

4. Operational Cost Pressures

Business owners point out that they are already under pressure from high energy bills, labour costs, national insurance increases and general inflation. Added rate increases at the same time feel like a disproportionate tax burden, exacerbating financial strains. Some sector leaders describe the situation as a "double hit" of rising costs and higher property valuations (since inflation influences the underlying rental values used in valuations).

The Standard

5. Competitiveness & Perception of Unfairness

Industry bodies — including hospitality associations and business federations — argue that the current system is unfair, often penalises physical retail and hospitality more than large distribution or tech firms, and hasn't adapted to structural changes in the economy. They want broader reform, not just temporary fixes.

Examples of Current Protests

Recent business pushback has included:

Pub owners saying changes could cost tens of thousands more per year on rates bills.

Hundreds of pubs and hospitality venues "barring" MPs in protest at perceived tax burdens.

Calls from industry groups for urgent financial support or targeted relief.

Trade associations warning that rates hikes could contribute to business closures and damage local economies.

Businesses are explicitly pointing to both the removal of COVID-era relief and the cumulative impact of revaluation, higher multipliers, and broader cost pressures as reasons for their protests.

Is This Solely Due to the End of COVID Allowances?

No — it's not solely due to COVID relief ending. While the withdrawal of temporary pandemic support is one major factor, businesses are protesting because:

Revaluations are exposing them to much higher rateable values

New multipliers change how much tax they owe, sometimes disproportionately

Scotland and England’s different policy choices mean unequal support between nations

Underlying cost pressures (inflation, energy, wages) make higher bills feel intolerable

Many businesses believe the fundamental business rates system is outdated and unfair

The end of COVID relief triggered and amplified financial pain, but the protests reflect deeper structural and policy concerns about how business rates are calculated, how reliefs are targeted, and how markets have changed since the last valuations.

Business rates are a commercial property tax based on rateable value × multiplier; systems differ between England and Scotland.

COVID-era discounts are ending, exposing underlying tax liabilities that were suppressed during the pandemic.

A 2026 revaluation and new multiplier rules mean many bills are rising sharply.

Businesses are protesting because combined cost pressures — not only the end of temporary relief — threaten viability, competitiveness, and investment.

There is a widespread call for broader reform, not just short-term fixes.

House of Commons Library Business rates the 2026 revaluation