Why the Price of Copper Is Soaring — and How It's Making Everyday Goods More Expensive

9th January 2026

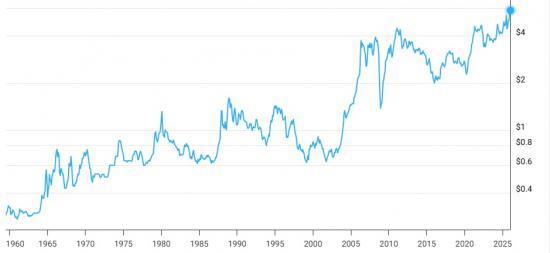

Copper is often called "the metal with a PhD in economics." The reason is simple: when copper prices rise, it usually signals powerful changes underway in the global economy. Today, copper prices are soaring to historic levels — and the effects are being felt far beyond commodity markets, quietly pushing up the cost of many everyday goods.

The Forces Driving Copper Prices Higher

At the heart of copper's surge is a growing imbalance between supply and demand.

On the demand side, the world is becoming more electrified. Electric vehicles, renewable energy systems, data centres, artificial intelligence infrastructure, and upgraded power grids all require vast amounts of copper. An electric vehicle, for example, can use two to four times more copper than a traditional gasoline car. Wind turbines, solar farms, and battery storage facilities rely heavily on copper wiring and components. Meanwhile, the rapid build-out of AI data centres — which require dense electrical cabling and cooling systems — is adding a new, fast-growing source of demand.

At the same time, copper supply is struggling to keep pace. Many of the world's largest copper mines are aging, producing lower yields than in the past. New mines are difficult, expensive, and slow to develop, often taking a decade or more before they become operational. Labor disputes, environmental regulations, water shortages, and political instability in key producing regions such as Chile and Peru have further constrained output. As a result, inventories remain tight, leaving little buffer when demand accelerates.

Geopolitical and economic factors have also played a role. Concerns about supply security, trade policies, and strategic stockpiling have encouraged governments and companies to secure copper supplies in advance, adding further pressure to prices.

How Rising Copper Prices Affect the Cost of Goods

Because copper is a foundational input across so many industries, higher prices don’t stay confined to metal markets. They spread throughout supply chains, gradually increasing the cost of finished goods.

Electronics and consumer technology are among the most affected. Smartphones, laptops, tablets, televisions, routers, and gaming consoles all rely on copper for circuit boards, wiring, motors, and heat dissipation. Even small increases in copper costs can add up when millions of units are produced.

Home appliances are another major category. Refrigerators, air conditioners, washing machines, dryers, microwaves, and induction cooktops contain copper coils, motors, and compressors. As copper prices rise, manufacturers face higher production costs, which are often passed on to consumers through higher retail prices.

Automobiles, particularly electric and hybrid vehicles, are heavily exposed. Copper is used extensively in wiring harnesses, motors, inverters, charging systems, and onboard electronics. Rising copper prices can increase vehicle costs or squeeze manufacturers’ margins, potentially slowing adoption or raising sticker prices.

Construction and housing costs are also affected. Copper is essential for electrical wiring, plumbing, HVAC systems, roofing materials, and renewable energy installations in buildings. Higher copper prices translate into more expensive new homes, renovations, and infrastructure projects.

Beyond these major sectors, the ripple effects extend even further:

Power cables and electrical equipment, including transformers and generators

Renewable energy installations, such as solar panels, wind turbines, and grid-scale batteries

Industrial machinery and factory equipment

Telecommunications infrastructure, including 5G towers and fibre-copper hybrid networks

Public infrastructure, such as rail systems, charging stations, and smart-city projects

Cookware, plumbing fixtures, and household hardware

Medical equipment, including imaging machines and hospital power systems

Defence and aerospace equipment, where reliability and conductivity are critical

In many cases, companies try to absorb some of the cost increase, but sustained price rises usually make their way to consumers over time.

Inflationary Pressure and the Bigger Economic Picture

Because copper touches so many parts of the economy, rising prices can contribute to broader inflation. When manufacturers, builders, and utilities face higher input costs, those costs tend to show up in consumer prices, service fees, or reduced product quality. This can erode purchasing power and complicate efforts by central banks to control inflation.

Some companies attempt to substitute copper with aluminium or other materials, but these alternatives are often less efficient, less durable, or subject to their own supply constraints. As a result, substitution can only partially offset rising costs.

A Metal That Reflects the Future

Copper’s price surge is not just a story about scarcity — it is a reflection of a world in transition. Electrification, decarbonization, digitalization, and automation all depend on copper, making it one of the most strategically important materials of the modern economy.

For consumers, this means higher prices for many goods may not be temporary. For businesses and policymakers, it highlights the challenge of building a more electric and sustainable future while ensuring the raw materials needed to support it.

In short, when copper prices rise, they are telling us something important: the demand for energy, technology, and infrastructure is growing faster than the world’s ability to supply the materials that make them possible.