Why your mortgage bill might rise as rates fall - Everything you need to know about 2026's mortgage mystery

16th January 2026

I've been writing about rising mortgage rates for some time now. During that time, mortgage interest has become an increasingly big deal. Last year, around 8 million British households stumped up a total of £65 billion in mortgage interest - almost double the £35 billion interest bill in 2019.1

But it's not just the sheer scale of all this that is interesting here. More mind bending has been the counter-intuitive ways mortgage rates have moved as the Bank of England initially increased, and then cut, its policy rates. The Bank is now nearly 18 months into its rate-cutting cycle, but, to many, it doesn't feel like it.

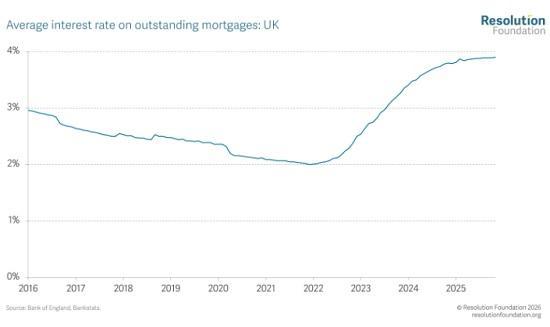

Taking out a mortgage today is cheaper than it was a few years ago, and savers are getting less interest too. But if we look at the stock of all outstanding mortgages - rather than just new ones - we're set to see aggregate interest payments rise this year, and with it a rising mortgage interest bill for the nation, even as the Bank (presumably) continues to cut rates.

Huh? How does that happen? It's doubly confusing when you keep in mind that the average rate on outstanding mortgages in Britain had flattened off by the end of 2025.

How can payments be rising as rates fall? And when will households' aggregate interest bill finally start to come down?

Let me explain how this can happen, with some simple arithmetic on stocks and flows.

A key influence on the average interest rate across the stock of mortgages is the average rate on the flow of new mortgages coming into the stock each month. These can be first time buyers, home movers, or simply people remortgaging when their existing deal expires.

As you'd expect given cuts from the Bank of England, the average rate on these new mortgages fell in 2025. But this started to level off by the end of the year (it fell by less than 0.1 percentage points between July and November).

As of November, it remains above the average rate on the stock. Early signs in 2026 are for further modest falls in new mortgage rates, but it may be some time before the average rate on new mortgage rates is below the average rate on the stock. So, for a while at least, new mortgages will be pulling up the overall average.

Author

Simon PittawaySimon Pittaway

Simon joined the Resolution Foundation in February 2023. His work focuses on wealth inequality, household balance sheets and macroeconomic policy. Previously, Simon worked at the Bank of England in a number of roles covering macroprudential policy, household and corporate debt, and financial markets. He has a BA and an MPhil in Economics from the University of Cambridge.

Read the full Resolution Foundation article HERE