Make the Most of the Sales by Earning Cash Back With Bank of Scotland Everyday Offers

24th December 2014

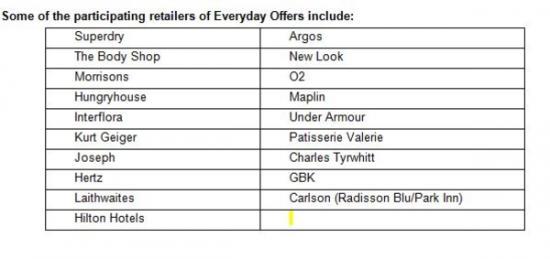

In the year since Bank of Scotland launched Everyday Offers, Bank of Scotland customers have benefitted by earning up to 15% cash back on their everyday spending at places including Argos, The Body Shop, Morrisons and O2, through the initiative. During the festive sales, it's not too late for savvy shoppers to make the most of their spending by selecting the participating merchants they want to activate for use on their next purchases.

Everyday Offers - earn cash back on last minute Christmas shopping

For those still to do a bit of last minute Christmas shopping, you can earn cash back at Maplin and Argos so you don't miss out on that perfect present, or you can always treat yourself in the sales. If you're still looking for the perfect party outfit or something warm to wear at the New Year street parties, you can also earn cash back at Superdry, Joseph, Charles Tyrwhitt and New Look during December and January.

Why not have a break during your shopping and pop in to Patisserie Valerie for some self-indulgence in the most exquisite cakes and pastries you will ever feast your eyes on and earn cash back at the same time. And if, like many of us, your New Year resolution is to get fit, then take advantage of Everyday Offers and kit yourself out at Under Armour with sports gear that will keep you cool, dry and light throughout the course of a game, practice or workout.

It's On Us - over £150,000 of transactions refunded to eligible customers

At the same time, Bank of Scotland has refunded over £150,000 worth of transactions to customers who have activated the 'It's On Us' aspect of Everyday Offers1. Every month Bank of Scotland randomly selects 500 debit and credit card purchases of up to £500 and pays back the value of those transactions to the customer's current account2.

So far, five lucky customers have seen themselves reimbursed for the most expensive single transactions yet, including store purchases, flights and online spending.

Highest single refunds3

£443.88 Ryanair

£428.97 Ebay

£422.56 ATS Euromaster

£378.98 Easyjet

£376.00 In-storesavings.com

Not surprisingly, the most common It's On Us refunds by far have been for groceries, averaging at £69.76 per transaction. Petrol is the second most frequent reimbursement (£59.15 average), while in third place, Scotland's love for fashion means some lucky customers have received on average £77.44 back through It's On Us. Understandably, some of the highest amounts refunded have been for travel, with 40% of those being for £200 or more.

Most popular refunds (average) 3

Groceries : £69.76

Petrol : £59.15

Fashion : £77.44

Restaurants : £72.81

Travel : £185.98

Garden / DIY : £147.52

Hotels : £134.23

Robin Bulloch, Managing Director, Bank of Scotland Community Bank said, "We're delighted to be able to give a little "thank you" to our customers and make them feel rewarded for the sorts of things they already spend on. If you're already signed up for Everyday Offers, make sure you also register for It's On Us for the chance to win back the value for something you've bought using your Bank of Scotland debit or credit card. Whether it's a coffee, a new winter coat or even a winter getaway, if you're not registered for It's On Us you won't be entered into the monthly free draw – so don't miss out!"

Everyday Offers applies to transactions made on Bank of Scotland branded debit and credit cards. The 'It's On Us' offer has certain exclusions, including gambling and adult sites.

More details -

You must be the main cardholder and over the age of 18.

1 To participate in “It's On Us” you must hold a Bank of Scotland branded personal current account which offers a debit card. You may also hold a Bank of Scotland branded personal credit card.

2 Cashback is paid directly into the customer's personal current account on or just before the last working day of the following month. Payments over a month end, weekend or bank holiday may affect the date when the cashback will be paid.

3 It's On Us qualifying period of Feb 2014 – Dec 2014.

Related Businesses

Related Articles