Roadshow To Grow Level Of Specialist Employee Ownership Advice Available To Businesses In Scotland

3rd April 2019

The Law Society of Scotland, The Institute of Chartered Accountants Scotland (ICAS) and Co-operative Development Scotland are joining forces to promote employee ownership amongst Scotland's professional advisers.

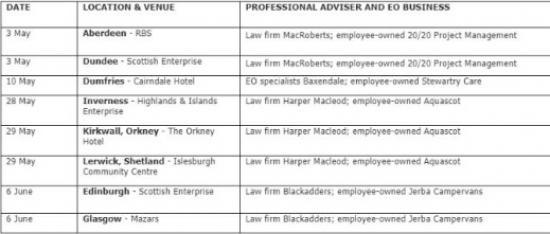

The partners are coming together to host a unique series of events on employee ownership for members of the legal, accounting and banking professions. Taking place across the length and breadth of the country in May and June, the roadshow is designed to raise awareness of the important role professional advisers play in informing clients about employee ownership as a business succession model, and to increase the number of firms that are able to offer specialist guidance in this area.

Entitled Selling a business to an Employee Ownership Trust and comprising presentations from some of Scotland's leading firms with expertise in employee buyouts, the roadshow coincides with the growing popularity of employee ownership. The number of employee-owned businesses operating in Scotland has trebled over the past five years and is expected to grow at an accelerated rate in the future.

Sarah Deas, director of CDS, an arm of Scottish Enterprise, said: "Promoting employee ownership helps drive growth in the economy and create greater wealth equality in society. Our partnership with The Law Society of Scotland and ICAS will enable us to raise professional advisers' awareness of the advantages of this model of business succession. And increasing the number of firms which are able to offer in-depth specialist guidance on employee ownership to their clients will greatly benefit businesses all over Scotland."

Alison Atack, president of the Law Society of Scotland, said: "Employee owned organisations have proven to be highly successful in recent years and were particularly resilient during and following the economic downturn, with research showing that employee-owned firms outperformed similar companies and achieved higher sales turnover and maintained higher employee numbers.

"For any business, getting the right advice is essential. We want to ensure that as professional advisers, Scottish solicitors understand the particular needs of employee-owned businesses, as well as any specific challenges they face, and can provide the advice and support to help them thrive in the long term."

Bernard Dunn CA, ICAS council member, added: “We welcome the opportunity to raise awareness across accountants and advisers of employee ownership as a potential business structure, particularly in the context of a vison for a fairer society, enhanced shareholder rights and moderation of executive pay. Ultimately a business needs to choose the model which helps it achieve its objectives and best fits its culture. It is important that advisers are well placed to inform employees on both the risks and opportunities so they can make the right decision for their business."

The roadshow kicks off at the beginning of May with events in Aberdeen and Dundee.

It then takes in Dumfries, Inverness, Orkney and Shetland before concluding in early June with sessions in Edinburgh and Glasgow. The events will feature sessions from businesses which have successfully become employee-owned, such as Jerba Campervans in North Berwick, which saw a 23% rise in turnover in its first year of employee ownership, and Stewartry Care in Dalbeattie, which was named Scotland’s Care at Home Provider of the Year at the Scottish Care Awards last year.

Since September 2014, shareholders have been able to sell a controlling interest in their company to an EOT for full market value without incurring capital gains tax liabilities. The EOT creates an immediate purchaser for a trading company of any size in any sector and then holds the business shares for and on behalf of the employees.

Whilst there are quite generous tax reliefs available, there are also numerous conditions to be met and the forthcoming partnership events for professional advisers will explain these in more detail.

There are substantial non-tax benefits associated with being owned by an EOT - including the fact that employees have a stake in their company - resulting in greater employee engagement and commitment.

In addition, companies can make tax-free payments to their employees which are currently restricted to £3,600 per tax year.

Places can be booked for The Selling a business to an Employee Ownership Trust roadshow at http://bit.ly/EORoadshow19 where more details on each event are also available.

Source - https://scottishfinancialnews.com/