Credit Union Membership Continues To Increase

2nd May 2019

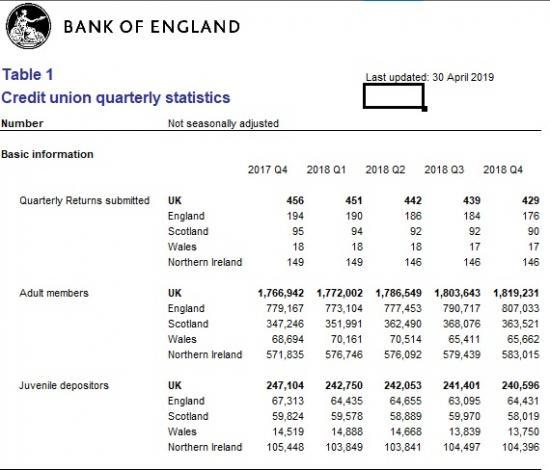

The latest quarterly statistics December 2018 issued by the Bank of England show that membership of credit unions continues to increase and now stands at 2,059,827 adult and Junior members. In 2008 membership was just over 650,000 and the rise in membership is due to range of factors from the banking crisis, reduced interest payments from banks and the slow spread of information about what credit unions do. The Bank of England is the regulatory authority for credit unions in the UK

Savings also increased and are now well in excess of £3.5billion. Members can borrow at good rates and are covered by excellent insurance cover.

While junior memberships have fallen slightly this has more than been made up by increasing adult members some of whom have transferred from junior to adult memberships.

In Highlands and Islands the Hi-Scot Credit union has seen a gradual expansion of membership and loans. At the end of March 2019 membership stood at 3203. Full shares have risen to £3,515,334 with Junior deposits standing at £181,589. The Christmas Savings were at £24,456.

54% of the members of Hi-Scot were Female 46% male.

Loans to members at the end of March 2019 stood at £1,862,346 and continue to grow alongside membership increases.

Hi-Scot has moved with the times and last year opened up online services for checking balances and more.

All savings in credit unions are secured by Bank of England guarantees up to £85,000.

Membership of credit unions is increasing in the UK but has a long way to go to catch up with the membership levels in some other countries such as Ireland or USA. As of 2016, in the United States, there were 5,757 credit unions with 103.992 million members comprising 45.4 percent of the economically active population.

Hi-Scot are currently trying to increase the number of employers offering deductions from salary straight to savings in the credit union. Scottish Government has recently increased its support for Scottish Credit Unions - A new website - www.creditunions.scot - has been set up to offer advice and help people find their local credit union. As she visited Capital Credit Union in Edinburgh, Communities Secretary Aileen Campbell said:

"In helping build a fairer Scotland, we want to protect people from getting into unmanageable debt and falling into the hands of predatory, high cost lenders. A key part of this is making sure that people are aware of the financial services and fair alternatives available, including credit union membership. "Our new campaign will highlight the benefits of joining a credit union and I would encourage everyone to visit the new website to find out more.

See Hi-Scot web site at www.hi-scot.com