Uk Borrowing Up £7.2 Billion In First Half Of 2019-20

23rd October 2019

Report by the Office of Budget Responsibility - September 2019.

Mid-way through 2019-20, borrowing is up £7.2 billion on the same point last year, with strong growth in public spending outweighing more modest growth in receipts. Prospects for full-year borrowing will depend on the extent to which spending growth slows - as seems likely - and whether receipts growth is maintained - which depends in part on whether recent strength in average earnings growth continues.

Headlines

• Public sector net borrowing (PSNB) is estimated at £9.4 billion in September, £0.6 billion higher than a year earlier. It has risen in five out of six months so far in 2019-20.

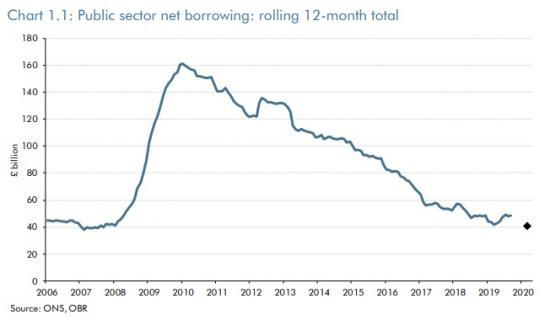

• Year-to-date borrowing was up £7.2 billion (21.6 per cent) on the same period last year. In our March forecast (including our estimate at the time of the student loans methodology change), we assumed a £7.2 billion (21.8 per cent) rise in borrowing for 2019-20 as a

whole. Stronger than expected spending growth is driving the faster rise in the deficit.

• Central government receipts (excluding PSNB-neutral transfers related to ‘quantitative easing') were up 6.9 per cent in September. Year-to-date receipts growth of 3.6 per cent is above our March forecast of a 2.6 per cent rise in 2019-20 (on a like-for-like basis).

• Central government spending (excluding PSNB-neutral grants to local authorities) was up 7.4 per cent in September and 5.4 per cent for the year to date, well above our March forecast of a 3.3 per cent rise in 2019-20 (on a like-for-like basis).

• Net debt was 1.2 per cent of GDP lower in September 2019 than a year earlier.

Full commentary

1. The Office for National Statistics and HM Treasury published their Statistical Bulletin on the September 2019 Public Sector Finances this morning, covering the first half of the 2019-20

fiscal year.

1

Each month the OBR provides a brief analysis of the data and a comparison with our most recent forecast, currently the March 2019 Economic and fiscal outlook (EFO).

2. Our next forecast will be published alongside the Chancellor's Budget on 6 November and it will largely be based on today's data, plus some administrative receipts data for October.

3. Substantial classification and other statistical changes incorporated into last month's release make like-for-like comparisons of our March forecast with the latest outturn difficult. Overall borrowing in 2018-19 was revised up by £17.8 billion. As with last month's commentary, we compare borrowing outturns on the new basis with a restated version of our March forecast

using estimates of the student loans change presented in that EFO. These underestimated the upward revision to borrowing in 2018-19 by £1.9 billion, largely due to the treatment of student loan sales, which we could not anticipate at the time. Elsewhere we have concentrated on year-on-year changes, which should be less affected by the various statistical changes.

Public sector net borrowing

4. Public sector net borrowing (PSNB) was £9.4 billion in September, £0.6 billion higher than last

year but £0.3 billion lower than market expectations. The £4.4 billion (6.7 per cent) rise in central government (CG) spending exceeded the £4.0 billion (6.9 per cent) rise in CG receipts.

Borrowing by local authorities was £0.2 billion higher than last year while borrowing by public corporations was £0.1 billion lower.

5. In the first half of 2019-20, the deficit is up £7.2 billion (21.6 per cent) on the first half of 2018-19. Our restated March forecast was for a £7.2 billion full-year rise in borrowing in 2019-20, so meeting that forecast would require borrowing to match last year's over the

second half of the year. We expected borrowing to rise this year as a result of slower growth in receipts due to the Budget 2018 policies raising the income tax personal allowance and higher rate threshold, and temporarily raising the annual investment allowance to £1 million, and slower growth in the main tax bases in 2019. In addition, CG spending was expected to rise faster than in 2018-19, particularly DEL spending on public services thanks to additional

resources for the NHS. But as described below the pace of CG spending growth in the first half of the year has outstripped the pick-up we assumed in our full-year forecast.

6. Chart 1.1 shows outturn PSNB on a 12-month rolling basis. Borrowing over the 12 months to September 2019 already exceeds our restated full-year forecast for 2019-20. It seems likely that the unwinding of various timing effects in the second half of the year will leave full-year borrowing lower than a simple extrapolation of the year-to-date rise - notably the backloaded profile of spending in 2018-19 that provides the base for year-on-year comparisons - but

there is considerable uncertainty around such a judgement.

See the full report at https://obr.uk/docs/dlm_uploads/October-2019-Commentary-on-the-Public-Finances.pdf