Financial Health Report - Scottish Universities and Colleges

7th July 2025

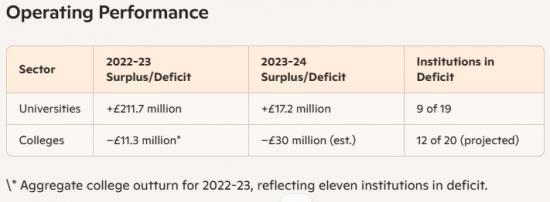

Scottish universities and colleges are navigating a sustained decline in public funding, significant cost pressures, and rising operating deficits.

Universities saw their collective underlying surplus tumble by 92% in 2023-24, while colleges face a real-terms funding cut of 17% since 2021-22. Both sectors project worsening deficits in 2024-25 and shrinking cash reserves, threatening long-term financial resilience.

Funding Trends

Universities have lost nearly 19% of real-term public funding per student since 2013-14, despite a one-off £25 million emergency package in 2025.

Colleges' core revenue fell by 17% in real terms between 2021-22 and 2024-25, with a cash-term reduction of £32.7 million in the current year.

Modest uplifts for pay deals, pensions and national insurance (£18.8 million total) partly offset cuts but leave underlying shortfalls.

Cost Pressures

Employer National Insurance and pension contributions have surged, adding an estimated £50 million to combined staff costs across the sector.

Energy, estates maintenance and digital transformation needs—particularly Reinforced autoclaved aerated concrete (RAAC) remediation—are driving unbudgeted capital and operating outlays.

Inflationary wage pressures and recruitment freezes signal continued tension between cost control and talent retention.

Liquidity and Borrowing

University cash buffers vary: some maintain multi-month reserves, while others draw down balances to plug gaps.

Colleges forecast a second consecutive drop in cash balances in 2024-25, elevating risk around payroll and operational continuity.

Modest upticks in sector borrowing fund capital projects but increase debt servicing burdens as interest rates remain high.

Mitigation Measures

Both sectors are pursuing voluntary severance, recruitment freezes and course rationalisation to reduce headcount and costs.

Universities prioritise high-demand programmes (medicine, STEM, AI) and scale back niche humanities and language courses.

Colleges seek clearer government direction on strategic priorities and explore shared services, campus consolidations, and digital efficiency gains.

Outlook and Recommendations

Enhanced Funding Models Recalibrate per-student funding to reflect rising costs and strategic priorities, with multi-year settlements for planning certainty.

Targeted Capital Support Allocate dedicated capital grants for critical Reinforced autoclaved aerated concrete (RAAC) remediation and net-zero upgrades to relieve operational budgets.

Sector Collaboration Encourage universities and colleges to pool administrative functions, share infrastructures and co-develop in-demand curricula.

Financial Transparency Institute regular sector-wide stress testing and public reporting to identify at-risk institutions early and target support.

Strategic Priority Setting Clarify the distinct roles of universities and colleges in the post-16 ecosystem to guide resource allocation and avoid duplication.

Without prompt policy adjustments and sustained investment, Scottish higher and further education institutions will face escalating deficits, eroding their capacity to deliver teaching, research and skills training critical to the nation's future.

Financial Position of the University of the Highlands and Islands

The University of the Highlands and Islands (UHI) is a tertiary partnership serving over 36,000 students across 70 teaching and learning centres. UHI drives regional economic growth, contributing roughly £560 million annually and supporting about 6,200 jobs in the Highlands, Islands, Moray and Perthshire.

UHI's latest accounts demonstrate a robust liquidity position and strengthened pension outlook, positioning the partnership to deliver its long-term strategy. However, sustaining this trajectory depends on stable public funding, successful delivery of capital projects and continued growth in student numbers.

Key Balance Sheet Metrics (2020/21)

Cash and term deposit investments: £31.5 million

Pension liability reduction: from £30.1 million to £8.8 million

Net current liability: £0.3 million, compared with net current assets of £4.9 million the prior year

These figures reflect an improved overall balance sheet, thanks largely to lower pension deficits and healthy liquidity reserves.

2023/24 Financial Highlights

While full line-by-line outturns for 2023/24 are detailed in UHI's Statutory Accounts to 31 July 2024, the Court’s report notes:

Continued prudent cash management, with reserves maintained to fund core operations and strategic transformation.

Investment in digital infrastructure and estate upgrades, including RAAC remediation, funded through a mix of SFC grants and internal cash flows.

Alignment with the 2030 strategy themes—teaching excellence, research impact, enterprise growth, sustainability and operational efficiency—underpinned by stable financial governance.

Liquidity and Funding Risks

Reliance on Scottish Funding Council grants exposes UHI to annual funding fluctuations and real-terms cuts.

Ongoing capital requirements for campus modernisation and environmental targets may strain cash buffers if grant levels do not keep pace.

Partner colleges within the UHI network face varying liquidity pressures, with some reporting tight cash positions and forecast deficits.

A detailed report a

https://www.universities-scotland.ac.uk/wp-content/uploads/2025/06/US-Fin-Sustainability-v-1.0.pdf

Pdf 4 pages

Related Businesses

Related Articles