2017/2018 Council Tax

20th February 2017

From 1 April 2017 the Scottish Government is changing the basis on which properties are assessed for Council Tax and this will increase the charge for Council Tax properties that are banded E to H.

The Highland Council has no discretion in this matter and must apply these increases to the Council Tax charges from 1 April 2017. Households living in properties in Bands A-D are not affected by these increases.

Further information on the Council Tax increases by the Scottish Government can be found on their website at:

• www.gov.scot/Topics/Government/local-government/17999/counciltax

To check what band your property falls under visit the Assessor's web site at:

• www.saa.gov.uk/

Queries relating to Council Tax Bands must be made to the Assessor by emailing assessor@highland.gov.uk or by phoning 01463 703311.

In addition to the increase in Council Tax set by the Scottish Government on properties falling within Bands E to H, The Highland Council has been given the flexibility to increase Council Tax on all properties, Bands A to H, by up to 3% from 1 April 2017. Council Tax legislation, set by the Scottish Government, determines any increase must be applied to all Bands in A to H.

At the meeting of the Highland Council on 16 February 2017 it was agreed to increase Council Tax on all properties by 3% from 1 April 2017.

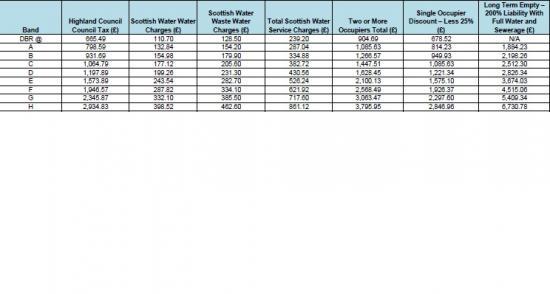

Council Tax for 2017/2018 can be found at: www.highland.gov.uk/downloads/download/525/council_tax_rates.

Scottish Water and Waste Water Service charges are also shown and these charges are set by Scottish Water.

A comparison of Council Tax Charges between 2016/2017 and 2017/2018 can also be found at www.highland.gov.uk/downloads/download/525/council_tax_rates

If households would like support with their personal budgeting they should contact the Council's Welfare Support Team at welfare.support@highland.gov.uk or by phoning 0800 0901004. This support includes checking and claiming your entitlement to all benefits.

Alternatively households may wish to contact their local Citizens Advice Bureau which provides a service on behalf of the Council to help individuals and households manage debts.

Financial assistance is available for those on low incomes to reduce their Council Tax bills. This is called Council Tax Reduction. A leaflet providing details of this relief can be found at www.highland.gov.uk/counciltax

Households already in receipt of Council Tax Reduction will have their entitlement automatically recalculated.

Households can check whether they are eligible for assistance by completing the Highland Council’s innovative ‘Apply Once’ online application form at www.highland.gov.uk/applyonce

This form will also automatically identify any other entitlements that are administered by the Council based on the individual’s circumstances. Households supply their details only once and the Council will put into payment all entitlements that are legitimately available to them.

The 82,000 households who are currently paying their Council Tax by Direct Debit do not need to cancel or change their existing payment amount as this will be updated automatically from 1 April 2017. Households who wish to set up a Direct Debit for payment of their Council Tax can do so at www.highland.gov.uk/counciltax.

Related Businesses

Related Articles

Council welcomes Visitor Levy flexibility plan

The Highland Council welcomes moves by the Scottish Government to introduce greater flexibility on how it could design a Visitor Levy Scheme for consultation. The Visitor Levy (Scotland) Act 2024 currently provides local authorities with discretionary powers to implement percentage-based levies following statutory consultation.Highland Council is reaching out for views to shape its next 26/27 budget.

As it looks to set out its forthcoming priorities, the council is seeking involvement from members of the public, including businesses, community groups, parents, and young people. All their opinions are going to be crucial in deciding how Highland Council will take on its budget challenge for 2026-2027.Have your say in Thurso's future £100million investment by attending public consultation events

Thurso is to benefit from £100m investment in education and community facilities and are rolling out the first phase of public consultations on 9 and 10 December 2025. The Highland Council is inviting people that live, work, or study in Thurso, to come along to the public consultation events to have their say; this is an opportunity to help shape the future of Thurso, to gather views and ideas.Finding new owners for empty homes - Scheme launched to help return more empty homes to active use

A new online portal has been launched to bring empty homeowners together with prospective buyers or developers with the aim of facilitating more properties to be used as homes again. Covering the whole of Scotland, this builds on the success of local pilots, referred to as "matchmaker schemes".Consideration for short term let control area in Skye and Raasay

Steps towards introducing a short term let control area have been considered by Highland Council's Isle of Skye and Raasay area committee. On Monday (1 December 2025) the committee heard evidence to justify the grounds for the introduction of a Short Term Let Control Area covering all or part of Skye and Raasay.Workforce North event spotlights Highland economy

EMPLOYERS and educators from across the Highlands have gathered to hear how a new initiative is aiming to transform the region's economy. Workforce North - A Call to Action brought together business leaders and teachers from primary and secondary schools from across the Highland Council area with a wide range of partners geared towards education, learning and skills development at Strathpeffer Pavillion.

Council calls for meaningful engagement from Home Office Over 300 Asylum Seekers Being Sent to Inverness

The Highland Council continues to call for meaningful engagement from the Home Office over its plans to temporarily accommodate up to 300 adult male asylum seekers at Cameron Barracks, Inverness. It follows an email on Monday from Alex Norris MP, Minister for Border Security and Asylum, to Council Leader, Raymond Bremner, which failed to answer questions raised by the Council or address community concerns.SSEN Transmission becomes first signatory to Highland Social Value Charter

SSEN Transmission has become the first company to sign up to the Highland Social Value Charter (HSVC), marking a significant milestone in delivering long-term socio-economic benefits for communities across the Highlands. Investment commitments from the company include funding for roads, new homes, jobs, and work for local contractors in addition to a local and regional fund for communities to apply to.Wick - Aberdeen PSO - Update issued 24/11/2025

The Highland Council continues to work through the procurement process for the provision of the Wick Public Service Obligation for the Highland Council. We have now entered the preferred bidder stage and have entered a standstill period.Highland Council winter road condition and school closure report for 25 November 2025

Maps of the Council's gritting routes by priority and policy are available online at www.highland.gov.uk/gritting (external link) The information provided is a summary of reports from operational staff and is intended to give a general indication of typical conditions in each area at a point in time. It is not intended to imply that any individual route is entirely snow and ice free and drivers must be aware that conditions can change rapidly and make their own assessment of conditions for travelling.